Small Company Loans - A Different To Standard Funding Choices

Article created by-Wentworth Morrow

Bank loan are an excellent choice for increasing finance for a service startup. Small company start-up finances are unsafe financings provided by private lenders to a businessperson for taking care of business activities. Small business startup fundings are made use of to perform daily organization transactions. Small business financing additionally describes the methods whereby an ambitious or currently existing local business owner gets cash to start a new company, get an existing business or infuse capital right into an already established service to fund future or present service task.

Capital is the major resource of functional funds for most organizations, particularly for start-ups. To raise funds for capital improvement, small company owners consider a variety of choices. Among these alternatives is to get instantaneous money from family and friends. This might not be the most effective method as your pals might not have the exact same line of believing as an establishment which gives small business loans. A lot of the time, individuals need to obtain cash versus their home equity to elevate start-up cash.

One more choice for local business owner seeking bank loan is to secure a car loan from the Small company Management or SBA. The Small Company Administration, likewise known as the SBA, is a federal government agency that was established to help entrepreneurs in America with developing, running as well as expanding organizations. The SBA guarantees financings to companies that meet pre-defined criteria, such as having less than one year of operation.

Local Business Start-up Loans rates of interest differ according to the lender. Banks are thought about prime loan providers because of their long-lasting relationship with the United States economic situation. Prime lending institutions are ranked by the federal government. If visit this web page link intend to obtain a funding from a financial institution, it is important to recognize how your rate of interest will be figured out. You can discover this out during a pre-approval conference where the financial institution representatives gather all the information regarding your company strategy, your credit report as well as the quantity of cash you have in the bank.

Given that the majority of financial institutions have an examining account, they are great resources of starting resources for businesses. Small companies can also get various other business fundings from the financial institution's online system. Lots of financial institutions additionally provide a reduced rate of interest for those that request a safeguarded funding. A typical choice for a secured loan is a house equity funding, which is based upon the value of a residence.

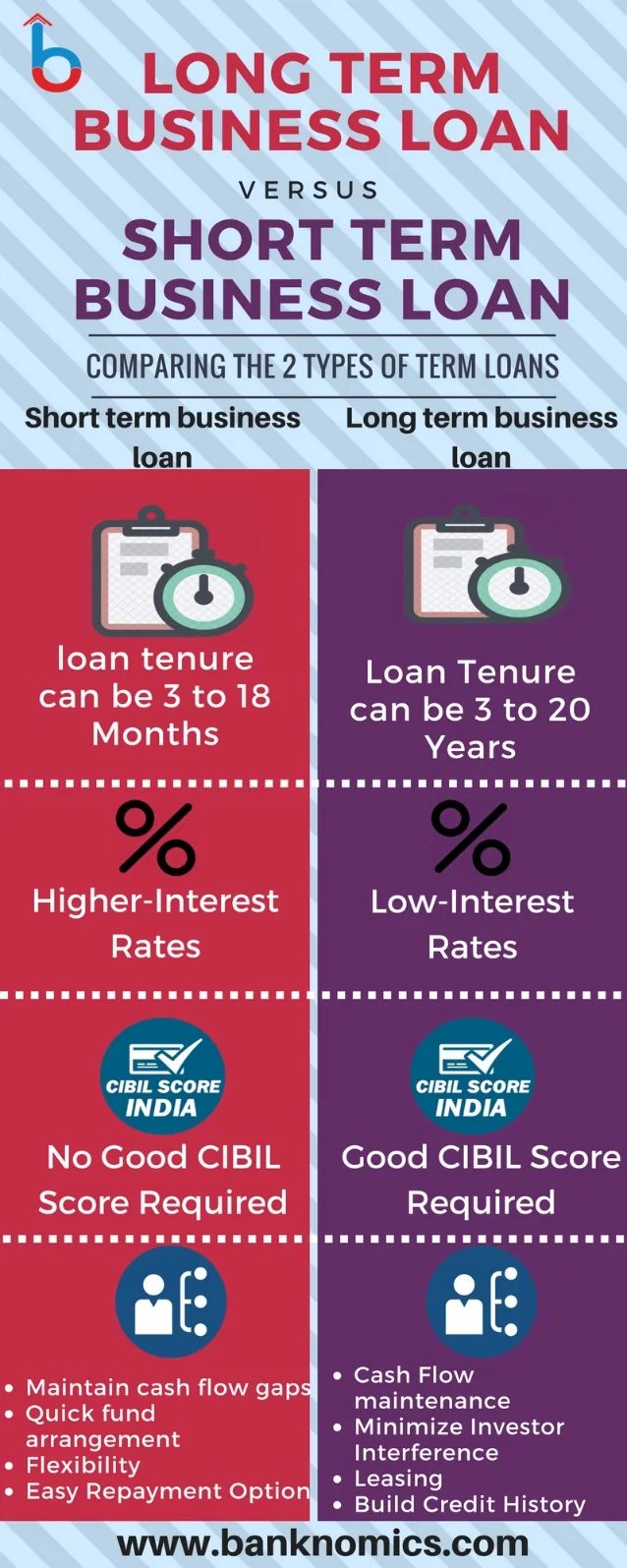

Rates of interest are likewise a factor to consider when getting a small business loan. It is always great to get quotes from different lending institutions to contrast the cost they would certainly bill for the amount of cash you require to borrow. does the small business administration give loans for land development will additionally provide special offers and low rate of interest for new companies. The size of the business and also its background will also influence the rate you will certainly be asked to pay for a loan. Bigger businesses have better access to resources and have actually been established for a longer period of time.

To get a bank loan via the Small company Administration, or SBA, you will need to supply personal as well as service details. You will certainly also be required to supply work info as well as any type of proof of security you have for your loan. You will require to be accepted for funding through the SBA before you can utilize it for your service. The SBA has unique programs that you can utilize to aid you obtain approved much faster.

https://blogfreely.net/beau961lizeth/small-business-loan-interest-fees-as-well-as-demands are typically temporary as well as can be restored by the loan provider. This helps entrepreneur that have troubles discovering standard funding for their company. Bank loan can help boost the cash flow of a company swiftly and also considerably without the inconvenience of long-term funding setups.